The Chicago Reporter is committed to producing stories that identify marginalized communities’ challenges and opportunities. In recent months, the racial bias in home appraisals has dominated the conversation in Chicago, the state, and across the country.

In Part 1 of 2 of Racial Bias In Home Appraisals, we outline what thought leaders have identified as some of the root causes for the widespread, pervasive disparities undervaluing Black and Brown homes, preventing them from attaining wealth.

“Owning a home means a shot at a better future. Owning a home is also a symbol of the benefit of hard work, the benefit of having ambition and aspiration for oneself and one’s family,” Vice President Kamala Harris said. “We don’t want to have a system that denies people an ability to have that goal simply because there’s bias in the system. We can correct that.” Harris announced on March 23 a new White House plan to eliminate racial bias in home appraisals.

President Joe Biden announced the formation of the Property Appraisal and Valuation Equity (PAVE) task force last June to solve home appraisal inequities in the U.S.

The vice president was joined by Black homeowners like Tenisha Tate-Austin, who shared stories of having homes undervalued during appraisals. Tate-Austin and her husband, Paul, from Marin County, California, filed a lawsuit late last year saying they were victims of appraisal bias. After spending months on renovations, a white appraiser valued their home much lower than they had anticipated. Then, when a white friend showed the couple’s home as her own, its appraisal rose $500,000. The Department of Justice filed a statement of interest in the couple’s claim in order to investigate if the appraisers in the Tate-Austin case are liable under the Fair Housing Act for discriminating on the basis of race.

“As soon as I opened the door, the entire body language of the appraiser changed,” said Don Robinson, a resident of the Woodlawn neighborhood of Chicago’s South Side. “He physically shutdown.”

Robinson and his wife, Solonge, have a similar story. The couple renovated their 19 century house and in 2020 decided to refinance it, which required an appraisal. The couple was expecting the value of their home to be $660,000. Instead, it was assessed at $480,000.

Robinson is Black, and the appraiser is white.

According to a Federal Home Loan Mortgage Corporation (Freddie Mac) study, Black and Brown homeowners are low-balled by bank appraisers compared to their white counterparts.

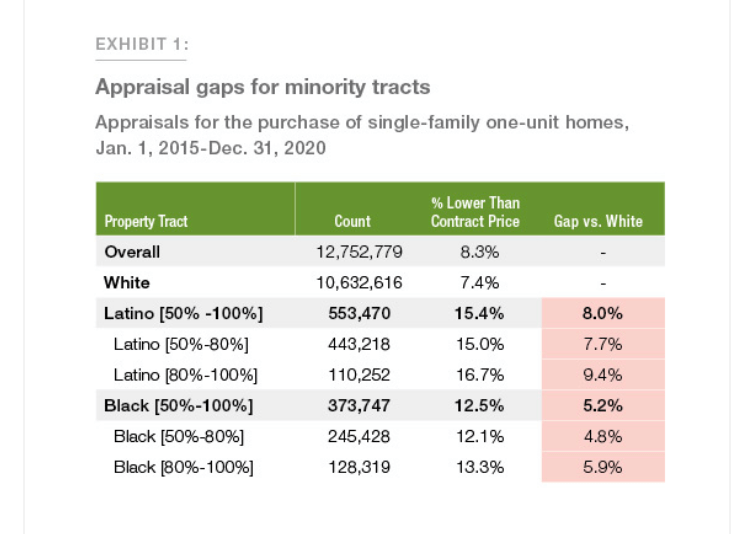

Freddie Mac’s analysis of more than 12 million appraisals between 2015 and 2020 adds further evidence of an ascending racial and ethnic divide. The report finds that 7.4 percent of appraisals in majority-white census areas were below a property’s contract price. However, that figure jumped to 12.5 percent for Black regions and 15.4 percent for Hispanic-Latino census districts. That translates to the white homeowner’s property being assessed at $180,000, while the Black homeowner’s assessment is $170,000 and the low end is the Latino homeowner who gets a $167,500 assessment.

Lenders require appraisals in purchasing or refinancing a home with a mortgage. An appraisal is presumably an unbiased professional opinion of a home’s value. A report is produced based on an in-person inspection, using recent sales of similar properties (comparable properties or “comps”), current market trends, and aspects of the home (amenities, floor plan, square footage) to determine the property’s appraisal value.

“When we got that first report back, it was shocking, ” said Solonge. “We felt confident based on the information. Not (our) feelings; based only on the information,” she said. “This is Don’s central place of work.” Don is a Southside real estate broker with Coldwell Banker Residential Brokerage.

National studies found that appraisers regularly overlook higher-value comps and instead choose comps based on neighborhood racial demographics, prohibited by state and federal law.

Don is a member of the Illinois REALTORS Discriminatory Appraisal Task Force, which aims to end discriminatory home appraisals.

The 22-member task force is made up of Illinois REALTORS members, lenders, and appraisers from across the state. Lutalo McGee is the task force chair, “It is very important that we get to the bottom line and eradicate these remaining vestiges of systemic injustices from the real estate appraisal and home loan process as soon as possible.”

In the late 1800s, practices stemming from Jim Crow laws like redlining began to suppress people of color from receiving loans to buy homes in other neighborhoods by a real estate industry that believed it was their ethical duty to preserve racial homogeneity.

Although the Fair Housing Act of 1968 did away with discriminatory race language in deciding home values, lingering harmful practices still target Black and Brown communities today.

“Redlining long, long denied Black homeowners a share in the American dream. That inequity continues today in the home appraisal system,” Harris said.

“Color and Collateral: Examining Individual and Neighborhood Effects of Race on Housing Valuation and Mortgage Lending,” a study commissioned by Illinois REALTORS, found that appraisers appeared to reward neighborhood homogeneity, appraising homes more highly if a neighborhood was all-white or all-Black and the borrower matched that demographic.

A history of undervaluing Black and Brown neighborhoods, segregation, and bias has prevented those communities from accumulating wealth through homeownership.

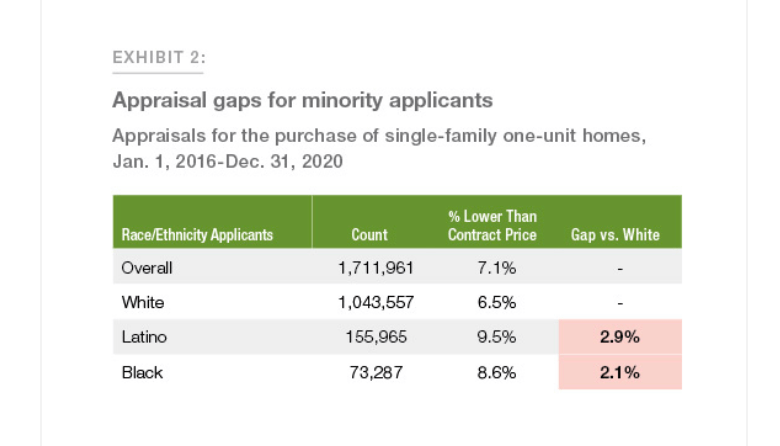

Disparities were discovered when just looking at the race of the mortgage applicant. According to the Freddie Mac analysis, 8.6 percent of Black applicants and 9.5 percent of Hispanic-Latino applicants received appraisals lower than the house contract price than 6.5 percent of white applicants.

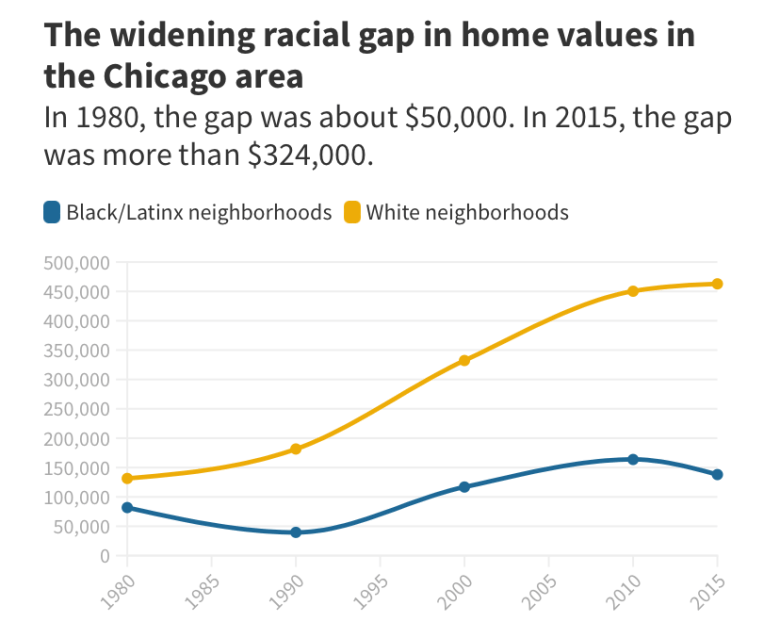

A recent WBEZ analysis found that the disparity between appraisal values in Black and Hispanic-Latino neighborhoods versus white neighborhoods in Chicago has increased more than six times since 1980. Other recent studies have shown that homes in Black communities are appraised at lower values than similar homes in white areas by 23 percent on average.

Visualization: Mary Hall/WBEZ.

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, sent a letter on February 22 to Marcia Fudge, Secretary of the United States Department of Housing and Urban Development (HUD) as well as the Appraisal Subcommittee, the Appraisal Foundation, and the Appraisal Institute (AI) regarding ongoing appraisal bias and discrimination, calling on the federal regulators and the Appraisal Institute to investigate appraiser misconduct and potential illegal discrimination.

Democratic Illinois Congressman Jesús “Chuy” Garcia serves with Waters on the committee, “The issue of discrimination at every point in the housing market, from loan applications to appraisals are exacerbated by the lack of diversity in the housing and appraisal fields.”

In the Chicago area, 5 percent of appraisers are African American, 3 percent are Latino, 1 percent are Asian, and 1 percent are “other,” while 90 percent are white, according to the U.S. Census.

“Latino and Black communities must not be shortchanged by a racist system that aims at keeping neighborhoods segregated and undervalued,” Garcia said.

The House Financial Services Committee has started hearings and investigations speaking with REALTORS, appraisers, experts, and affected communities. The next hearing, “Devalued, Denied, and Disrespected: How Home Appraisal Bias and Discrimination Are Hurting Homeowners and Communities of Color,” is scheduled for March 29.

States, counties, and municipalities should take action as well, he said, but evidently, changes in federal law are necessary because these practices are going on across the country.

“This has serious consequences for the wealth gap in our communities,” Rep. Garcia said. The next House Financial Services Committee hearing, “Devalued, Denied, and Disrespected: How Home Appraisal Bias and Discrimination Are Hurting Homeowners and Communities of Color,” is scheduled for March 29.

AI has stated it supports Congressional legislation establishing a task force to evaluate lender collateral underwriting and appraisal guidelines.

Until recently, AI did not acknowledge racism in the industry, dismissing complaints as the actions of a few individuals. “There is a history of redlining that has led to inequities in homeownership for people of color, and as a residential appraiser myself, when I see stories about consumers who feel they were treated differently because of their race, it is personally troubling because that is not who we are as a profession,” said Jody Bishop, Appraisal Institute President in a statement. “One of my top priorities is to advance diversity, equity, and inclusion in appraisal. We have a responsibility to the communities in which we work, to our membership, and to the future of this profession to identify these inequities and to enact solutions.” The Chicago Reporter tried several times and was denied an interview by AI.

The existing problems in the appraisal industry are years in the making, and the solutions might take as long due to the myriad of practices at the local, state, and federal level, said Jeff Baker, CEO of Illinois REALTORS.

The Illinois Realtors Discriminatory Appraisal Task Force focuses on three key areas: education and outreach, research, and policy. “Creating awareness is good,” said Baker. “So, what do we do about it now?”

For the Robinson family, their Woodlawn home is their dream home. They contested the appraisal of their house and lost but are hopeful that change will come about by adding their experience to the list of other people wronged.

In the 1920s, restrictive housing covenants kept people of color out of Woodlawn. One family, however, violated that covenant. When playwright Lorraine Hansberry was a child in 1937, her family moved into a home in Woodlawn. Their case fighting the covenants went all the way to the U.S. Supreme Court, and the Hansberrys won. The events inspired her 1959 play, A Raisin in the Sun––the first Broadway play by a Black woman.

In Part 2 of 2 of Racial Bias In Home Appraisals, we learn from lawmakers, industry leaders, and the community what solutions are (or should be) on the table to confront racial bias in the appraisal industry from enforcing laws, enacting new legislation, and empowering the public to act.

Cover Photo Credit: Illinois REALTORS