President Biden has announced a plan to forgive up to $20,000 of student debt for borrowers who earn a low-to-mid level income, but not all who qualify feel equally relieved.

The White House released a statement on August 24th describing a three-part plan to help relieve borrowers who financially struggled during and after the pandemic. The most prominent part of the plan will forgive up to $20,000 of student loans for Pell Grant recipients and up to $10,000 for non-Pell Grant recipients if the borrower made less than $125,000 in 2020 or 2021. The second portion will limit undergraduate monthly loan payments to no more than 5% of one’s income as opposed to the current 10% cap. The third portion proposes a statute saying borrowers can receive a credit return on student loans if they have worked at a nonprofit, in the armed services, or the government. The highly anticipated announcement comes after months of prolonged student loan payment pauses initially instituted in March 2020.

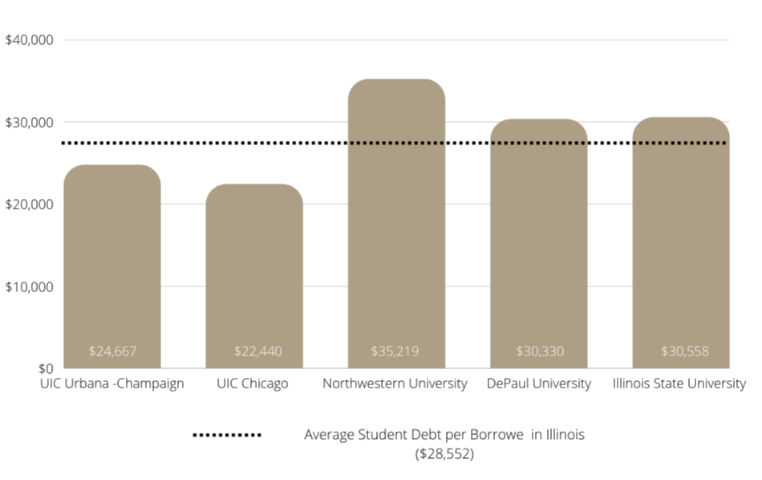

More than half of all Illinois college graduates take out student loans according to the Institute of College and Academic Success. Illinois borrowers graduate with an average of $36,531 in debt– the sixth-highest average balance per student in the nation. Finance firm Lending Tree reports that the White House’s plan will forgive the total amount of debt owed for 480,000 Illinois borrowers, but many will still have an outstanding balance- approximately 130,000 of which owing a staggering $100,000 or more.

Students of color historically have been disproportionately burdened by student loans when compared to their white counterparts. A study conducted by the Education Data Initiative found that black graduates owe an average $25,000 more in student loans than white graduates, and nearly half of all black graduates’ debt will increase 12.5% four years after graduation because of interest. The EDI reported that black indebted borrowers are more likely to encounter financial struggles caused by student loan payments than any other race.

D.J. Nuckles, a junior Digital Marketing and Advertising major at Roosevelt University, feels mixed emotions about the president’s promise. “It’s a weird situation- when I heard the news, I was happy but also suspicious,” said Nuckles. “They’ve been talking about this for years but nothing has ever happened.” However, Nuckles is hopeful the plan will increase educational opportunities for minority students and believes it will benefit his post-graduate life. “I think this is an opportunity for all of us,” he shared. “Many [minority students] don’t have the resources to pay for college, but now more people will have access to that. Coming to Roosevelt is not cheap, and I don’t come from a well-off family. I want to make a life in Chicago and it’s expensive to live here. It’s hard to balance finding a well-paying job, experiencing the city, paying rent and worrying about loans on top of all that. Not having to repay my full amount of loans will help in many senses.”

Bella Negron, a sophomore dance major at the University of Illinois, experienced a wave of relief when she learned she is eligible to have her student loans forgiven. “I am so excited”, she shared, “Now that I can worry less about how my family and I will pay back the money, I can focus more on my classes.” Negron hopes the promise of forgiveness will encourage a more diverse pool of students to attend a college or university. Despite her joy, Negron can’t help but wish it happened sooner. “I always thought student loan repayment plans were unfair- especially to minority students and those with disabilities. I’m excited this is happening, but there’s a part of me that still wishes for more.”

Illinois State Senator Celina Villanueva is a champion of accessible education who has created college board programming for inner city youth as well as a student-parent data access bill that helps parents who are also students learn about the additional resources available to them. “The plan will impact people on a spectrum. It may offer little for some and be a huge sigh of relief for people who have $10,000 or less left to pay,” the Senator shared. “Since the plan won’t necessarily impact current students, I can’t say it will impact graduation rates. However, the hope is now we have more comprehensive conversations about how student debt burdens our young people and their futures. I myself will be impacted- and I have put off buying a home because the reality is there is no way I can pay for everything else- a car, mortgage, down payments, and loans in the economy we are in.”

Despite the forgiveness plan, the Senator explained there are still many steps to be taken until students of color and minority students receive proportional opportunities to receive collegiate education. “There’s a separate conversation to be had about the barriers that prevent marginalized students from accessing higher education. There is a lot of gatekeeping over college education– intentional or not- whether it’s the metrics of the SAT, GPA’s, or financial barriers,” she said. “We do need to increase financial resources, but also shift the cultural competency of higher education to truly understand what those barriers are. ”

The senator acknowledged Illinois student loan borrowers will rack up an average debt higher than students in other states. “I find that appalling that Illinois students have to incur such a high amount of debt. We want students to come to universities in Illinois and stay in Illinois, but if that is proving to be insurmountable because of cost, then there need to be solutions,” said Senator Villanueva. The student loan forgiveness application is set to open in early October. To sign up for updates, visit www.studentaid.gov.