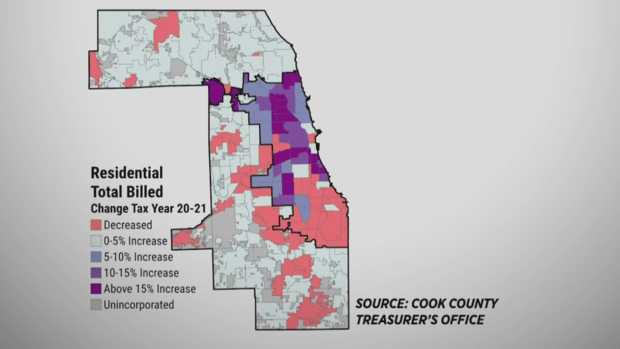

CHICAGO | Property taxes are up in Cook County; on average, homeowners saw an increase of 8 percent this year.

According to an analysis from Cook County Treasurer Maria Pappas’ office, taxes levied on real estate rose by 3.8 percent, to $16.7 billion, in 2021. The total amount billed countywide increased by $614 million over the previous tax year. As a result, homeowners are picking up $330 million.

Some gentrifying working-class Latino neighborhoods in Chicago saw their taxes jump dramatically. On the primarily Latino Lower West Side, homeowner’s median tax bill rose to $7,239 from $2,275 in 2020.

“The system is broken,” said Ald. Byron Sigcho-Lopez, whose 25th Ward covers much of the Lower West Side that saw the biggest hikes. “This is simply unethical.” Sigcho-Lopez blamed corrupt politicians and called for reforms to the property tax system.

“‘My property tax is too damn high’ – they have to pass it on to the renters,” said Moises Moreno, who runs The Pilsen Alliance, a social justice organization. Moreno said homeowners will feel the effects of the spike first, and renters will feel it on their next lease.

“There are still inequities in our property tax system and we need to straighten it out,” Pappas said. The increased tax burden is not shared equally. Homeowners will pay 54 percent of the rise, while businesses will pay 46 percent, the treasurer said.

Not all taxes are going up. Relief is coming to owners in predominantly Black neighborhoods. In West Garfield Park, homeowner taxes dropped by almost 45 percent. Decreases of $1,000 or more in commercial median taxes occurred on the South Side, including the Pullman, Burnside, Chatham, Calumet and South Chicago areas, reports The Real Deal.

Pappas pointed to several reasons behind the hikes:

- Tax increment financing districts

- Rising property assessments

- New state law allowing local governments to recoup losses from reassessed property taxes

The Cook County Treasurer called the law, known as a recapture provision, an “automatic tax increase” with “no oversight whatsoever.” That provision alone added $131 million to the county tax bill and accounted for one-fifth of the increase.

Pappas said the majority of property tax money goes to funding schools. To save homeowners from being priced out, she said county residents need to consider funding schools in other ways.

Property taxes also go toward infrastructure, public works projects, first responders, and more. Bills are calculated after several steps:

- Local governments, including school and park districts, set their property tax levy to help pay for operations

- The assessor sets the values of properties, then makes adjustments for exemptions or other incentives.

- The clerk then determines tax rates based on various levies and overall assessed values for each unit of government.

- The treasurer then sends out the bills, collects payments and distributes the money to local governments.

“The lack of political willingness to address this issue has cost us,” said 25th Ward Alderman Byron Sigcho-Lopez, who represents the Lower West Side. “Thousands of residents have been displaced, and when is it going to be enough?

Editor’s Notes: Homeowners can find their property tax bill by clicking HERE.